Smart Money Basics: Borrowing, Banking & Beyond

Smart Money Basics: Borrowing, Banking & Beyond

Share

2x per week

2x per week

Live video meetings

Live video meetings

Completed by 539 learners

Completed by 539 learners

Smart Money Basics: Borrowing, Banking & Beyond

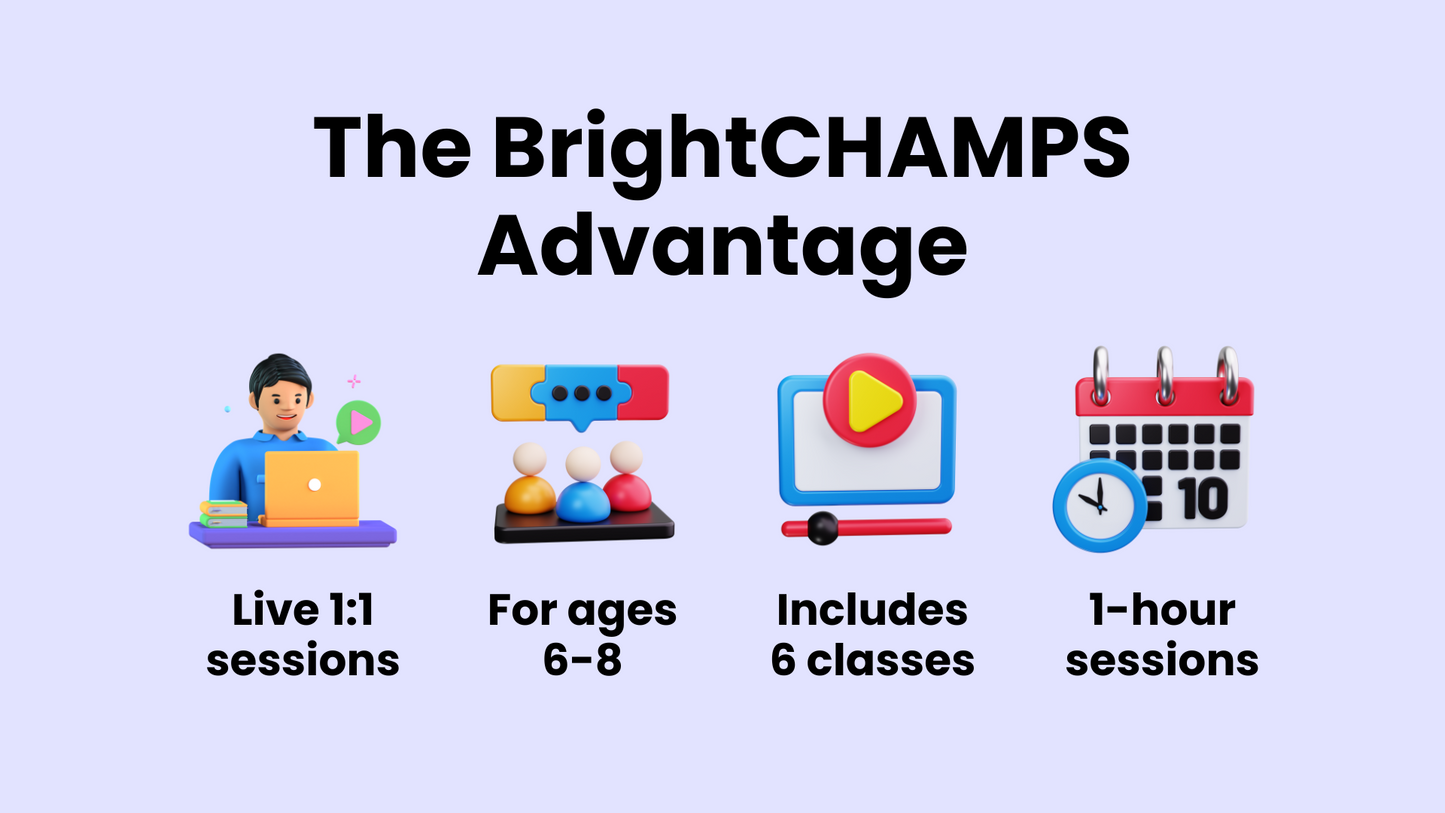

For ages 6-8

Includes 6 classes

1-hour session

Course Description

This course introduces students to the basics of borrowing, digital money, and credit scores, focusing on responsible borrowing and debt management. Students will explore modern banking tools, including digital lending and crowdfunding, gaining essential skills for informed financial decision-making.

เนื้อหาที่ย่อได้

Curriculum Outline

Lesson 1: Introduction to Borrowing

Learn the basics of borrowing, including what it means to borrow and different ways people can borrow money.

Lesson 2: Responsible Borrowing

Understand the costs associated with borrowing and how to borrow money responsibly.

Lesson 3: Understanding Digital Money

Explore how digital money works, from its journey through financial systems to the basics of cryptocurrency.

Lesson 4: Credit Score Essentials

Learn what a credit score is, how it affects borrowing, and ways to build and maintain a good score.

Lesson 5: Modern Borrowing Options

Explore digital lending, including peer-to-peer lending and crowdfunding, as new borrowing options.

Lesson 6: Loan Repayment

Understand how loan repayment works, with a focus on planning and methods for effectively repaying debt.

Tangible Outcome

Upon completing this course, students will master borrowing fundamentals, credit scores, digital money, and fintech. They will develop the skills to borrow responsibly, manage debt effectively, and utilize modern financial tools such as peer-to-peer lending and crowdfunding. Furthermore, students will learn to monitor and improve their credit scores while confidently navigating the evolving world of digital finance and innovative borrowing options.

Skills Honed

- Financial Decision-Making: Develop the ability to assess borrowing options and make informed financial choices.

- Debt Management: Learn strategies to plan, repay, and manage loans responsibly.

- Credit Score Improvement: Gain practical skills to build, monitor, and maintain a healthy credit score.

- Digital Finance Navigation: Understand and utilize modern financial tools like cryptocurrency, peer-to-peer lending, and crowdfunding.

- Problem-Solving: Enhance critical thinking to tackle real-world financial challenges effectively.

You Might Also Like

-

เพิ่มลงในตะกร้าสินค้า ขายหมดแล้ว

Money Basics: A Kid’s Guide to Personal Finance

4.76-8 Ages60 Mins$16.6 Per Class -

เพิ่มลงในตะกร้าสินค้า ขายหมดแล้ว

Banking Basics: A Kid's Guide to Understanding Banks

4.76-8 Ages60 Mins$24.83 Per Class -

เพิ่มลงในตะกร้าสินค้า ขายหมดแล้ว

Understanding Business Success: Profits, Risks, and Growth

4.712-16 Ages60 Mins$16.6 Per Class -

เพิ่มลงในตะกร้าสินค้า ขายหมดแล้ว

Entrepreneurship Foundations for Kids

4.712-16 Ages60 Mins$16.6 Per Class

BrightCHAMPS has formed a strategic collaboration with Harvard Business Publishing Education to integrate their esteemed content into our curriculum. Kids will get access to interactive Harvard ManageMentor® online courses on the website.